For investors seeking both platinum exposure and the credibility of a sovereign mint, the Canadian Platinum Maple Leaf stands in a class of its own.

The American Silver Eagle is the U.S. government’s official silver bullion coin, first minted in 1986.

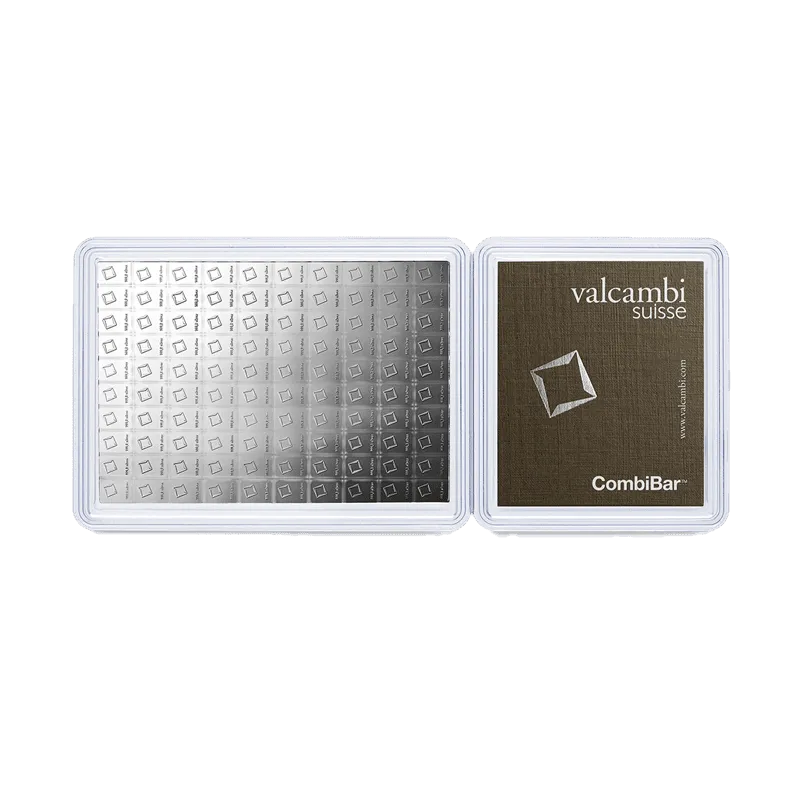

The Valcambi 100 gram Silver CombiBar is a standout in the world of physical silver because it combines quality, practicality, and adaptability.

The America the Beautiful Silver Coin Series was created to celebrate and protect the natural beauty of America’s National Parks and historical sites.

Silver bars and rounds are among the most straightforward ways to purchase physical silver, offering an investment that’s often valued close to the spot price of silver.

The Silver Rose Crown Guinea Coin is a tribute to the remarkable legacy of The East India Company and its pivotal role in global trade.

Silver Products

Silver has long been considered one of the most accessible precious metals for investors seeking to diversify their portfolios. Known for its industrial uses as well as its role as a store of value, silver is a powerful addition to any precious metals investment strategy.

At Berkshire Gold Group, we offer a selection of high-quality silver products, from bullion coins to bars, that are designed to fit a range of investment goals. Whether you’re just getting started with silver or looking to expand your holdings, we have a variety of options to meet your needs.

Why Invest in Silver?

Silver is often viewed as a more affordable alternative to gold, providing investors with a way to participate in the precious metals market without the higher upfront costs. It’s widely used in various industries, including electronics, renewable energy, and medical technology, making its demand highly relevant to both industrial and investment markets.

Affordability:

Silver is more accessible than gold, allowing investors to accumulate more of the metal for a lower initial investment. Its lower price point per ounce makes it a popular choice for both novice and seasoned investors.

Industrial Demand:

Silver plays an important role in industries such as electronics, solar energy, and healthcare. This industrial demand, combined with its limited supply, ensures that silver remains a valuable and sought-after metal.

Hedge Against Inflation:

Like gold, silver serves as a hedge against inflation and economic instability. Its value tends to rise when fiat currencies lose purchasing power, providing protection for long-term investors.

Diversification:

Adding silver to your portfolio helps diversify your precious metals holdings, balancing your risk and enhancing your financial security.

Our Silver Products

We offer a variety of silver products that are designed to meet your investment goals. These products are all carefully selected to provide you with high-quality, IRS-approved options for investment.

Silver Bullion Coins

Silver bullion coins are a popular choice for both individual investors and those looking to add silver to their IRA. With high purity and weight consistency, these coins are a reliable investment. Some of our silver bullion coin offerings include:

American Silver Eagle:

The most popular silver coin in the U.S., featuring a 1-ounce weight of .999 fine silver. This coin is recognized worldwide and is ideal for both investors and collectors.

Canadian Silver Maple Leaf:

Produced by the Royal Canadian Mint, this coin is 1 ounce of .9999 fine silver, offering one of the highest purities available in a silver coin.

Austrian Silver Philharmonic:

A 1-ounce coin produced by the Austrian Mint, this coin combines both purity (.999 fine silver) and beauty, with a design that pays tribute to the Vienna Philharmonic Orchestra.

Silver Bars

For larger investors silver bars provide an efficient way to invest in silver. These bars come in various sizes. Our silver bars include:

1 oz Silver Bars:

A great choice for investors looking for smaller increments of silver.

10 oz Silver Bars:

100 oz Silver Bars:

The largest option, ideal for investors looking to buy in bulk.

Semi-Numismatic Silver Coins

While silver bullion is a stable and liquid investment, semi-numismatic silver coins are another option for those seeking a blend of beauty and value. These coins typically have a slight premium over bullion coins due to their rarity or design features, but they still maintain their status as a sound investment. Popular semi-numismatic silver coins include:

Morgan Silver Dollars:

These historic coins, minted from 1878 to 1904 (and in 1921), hold value due to their rarity and popularity among investors.

Peace Silver Dollars:

Similar to Morgan Dollars, these coins were minted from 1921 to 1935 and are highly sought after for their iconic design and limited availability.

Why Silver is a Smart Investment

Silver’s value is driven not only by its precious metal status but also by its industrial applications. As more industries embrace silver for use in technology, renewable energy, and healthcare, the demand for silver continues to rise. Additionally, the limited supply of silver and its growing industrial demand means that it is likely to appreciate in value over time.

By investing in silver, you’re adding a tangible asset to your portfolio that can help protect your wealth from inflation, economic downturns, and geopolitical uncertainty. Silver provides a strong hedge against the volatility of financial markets and offers a practical way to diversify your holdings.

Frequently Asked Questions About Silver Products

Q: Why should I invest in silver instead of gold?

A: Silver offers a more affordable way to invest in precious metals and has a strong industrial demand, making it an attractive option for diversifying your portfolio. Silver can also experience greater price volatility, offering potential for higher returns during market upswings.

Q: How much silver should I include in my investment portfolio?

A: The ideal amount of silver in your portfolio depends on your risk tolerance, financial goals, and overall investment strategy. Many investors allocate between 10-20% of their precious metals portfolio to silver as a means of balancing the stability of gold with the potential growth of silver.

Q: Is silver a good hedge against inflation?

A: Yes, silver, like gold, is often used as a hedge against inflation. When fiat currencies lose value, the price of silver tends to rise, helping investors preserve their purchasing power.

Q: How do I buy silver through Berkshire Gold Group?

A: Simply contact us to discuss your investment goals. Our team will guide you through the process of selecting the right silver products, ensuring your purchases are secure and meet your financial objectives. We can also assist you with purchasing silver for an IRA if you’re looking to make tax-advantaged investments.

Q: Can I store silver in a self-directed IRA?

A: Yes, many silver bullion coins and bars are eligible for inclusion in a self-directed IRA. Berkshire Gold Group offers IRA-approved silver products, ensuring that you can store your silver securely within a tax-advantaged retirement account.

Ready to Invest in Silver?

If you’re ready to add silver to your portfolio, Berkshire Gold Group is here to help. Contact us today to learn more about our silver products and how we can help you secure your financial future with precious metals. Our team is dedicated to ensuring your investment journey is seamless and successful.

Silver’s value is driven not only by its precious metal status but also by its industrial applications. As more industries embrace silver for use in technology, renewable energy, and healthcare, the demand for silver continues to rise. Additionally, the limited supply of silver and its growing industrial demand means that it is likely to appreciate in value over time.

By investing in silver, you’re adding a tangible asset to your portfolio that can help protect your wealth from inflation, economic downturns, and geopolitical uncertainty. Silver provides a strong hedge against the volatility of financial markets and offers a practical way to diversify your holdings.

What Our Customers Are Saying

Nancy C.

“I wasn’t sure how to move my IRA into gold and silver, but everything was explained step by step. The process was simple, and I felt confident the whole way through.”

Charles M.

“There was no pressure at all. They treated me like family, and my metals were delivered within 10 days. I would definitely recommend them.”

George W.

“I had a 401(k) from a previous employer just sitting there. Berkshire Gold Group helped me roll it over into gold with no hassle and full transparency.”